Generic 401(K) Enroillment Form 2003-2026 free printable template

Show details

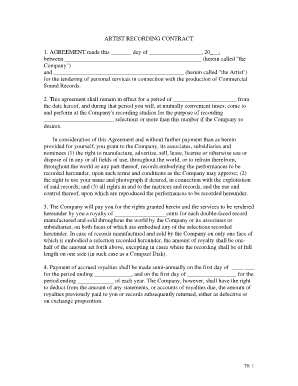

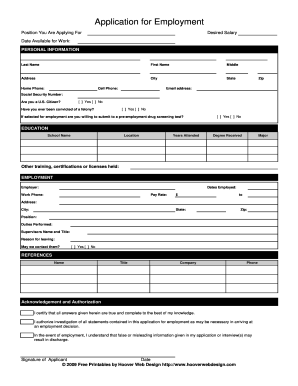

Generic 401K Enroillment Form Generic 401 k Plan Enrollment/ Change Form Indicate Action New Enrollment Contribution Change Discontinue Contribution Employee Data Last Name First Name Middle Name Employee Number Social Security Number Address City State Zip Date of hire Date of birth Marital Status Single Married I wish to contribute 0.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 401k enrollment form

Edit your 401k contribution form template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to fill out the based on your financial goals form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 401k forms online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit a 401 k enrollment form is a document employer to confirm participation in the plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 401k form

How to fill out Generic 401(K) Enroillment Form

01

Obtain the Generic 401(K) Enrollment Form from your employer or HR department.

02

Fill in your personal information, including your name, address, Social Security number, and date of birth.

03

Indicate your employment status and the date you started working.

04

Choose your contribution amount, either as a percentage of your salary or a fixed dollar amount.

05

Select the investment options that suit your retirement goals (e.g., stocks, bonds, mutual funds).

06

Review the employer match policy and indicate if you will participate.

07

Complete any additional sections regarding beneficiary designation.

08

Sign and date the form to confirm your selections.

09

Submit the completed form to your HR department or designated plan administrator.

Who needs Generic 401(K) Enroillment Form?

01

Employees who are eligible to participate in their employer's 401(K) retirement plan.

02

Individuals who want to save for retirement through tax-advantaged accounts.

03

New hires who wish to enroll in their employer's 401(K) plan.

04

Employees looking to make changes to their existing 401(K) enrollment or contribution levels.

Fill

401 k enrollment form purpose

: Try Risk Free

People Also Ask about to this rule if you take any distributions from your 401 k

What is a 401 K enrollment form?

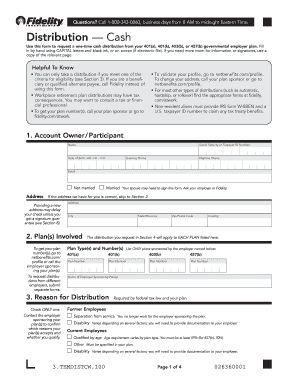

An automatic enrollment 401(k) planPDF allows an employer to automatically deduct a fixed percentage or amount from an employee's wages and contribute that amount to the retirement plan unless the employee has affirmatively chosen to contribute nothing or a different amount.

Do I need a tax form for 401k contributions?

In general, 401(k) contributions are not considered taxable income. This means you don't need to report 401(k) on your tax return. However, there are exceptions to this rule. If you take any distributions from your 401(k), you are legally required to report that on your tax return.

Is there a form for 401k contributions?

The amounts deferred under your 401(k) plan are reported on your Form W-2, Wage and Tax Statement. Although elective deferrals are not treated as current income for federal income tax purposes, they are included as wages subject to Social Security (FICA), Medicare, and federal unemployment taxes (FUTA).

Do 401k contributions have a tax form?

In general, 401(k) contributions are not considered taxable income. This means you don't need to report 401(k) on your tax return. However, there are exceptions to this rule. If you take any distributions from your 401(k), you are legally required to report that on your tax return.

What is the form for 401k contributions?

Use Form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit).

What are the IRS guidelines for 401k contributions?

The maximum amount that employees can contribute to their SIMPLE 401(k) accounts is $15,500 in 2023, ($14,000 in 2022, $13,500 in 2021 and in 2020 and $13,000 in 2019). See annual cost-of-living updates for more information. An additional catch-up contribution is allowed for employees aged 50 and over.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 401k election form template?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your 401k decline enrollment form and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an eSignature for the how to fill out generic 08 in Gmail?

Create your eSignature using pdfFiller and then eSign your 401k form pdf immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I fill out the generic 401k enrollment form is a in their employer's 401k retirement savings plan on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your 401k contribution form, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is Generic 401(K) Enrollment Form?

The Generic 401(K) Enrollment Form is a document used by employees to enroll in a 401(K) retirement savings plan offered by their employer. It collects essential personal information and election choices regarding contributions.

Who is required to file Generic 401(K) Enrollment Form?

Any employee who wishes to participate in their employer's 401(K) retirement plan is required to file the Generic 401(K) Enrollment Form.

How to fill out Generic 401(K) Enrollment Form?

To fill out the Generic 401(K) Enrollment Form, an employee must provide personal details such as name, address, Social Security number, and select contribution amounts, investment options, and any other required information as per the form's instructions.

What is the purpose of Generic 401(K) Enrollment Form?

The purpose of the Generic 401(K) Enrollment Form is to facilitate the enrollment process for employees to participate in the 401(K) plan, allowing them to save for retirement through payroll deductions and investment options.

What information must be reported on Generic 401(K) Enrollment Form?

The information that must be reported on the Generic 401(K) Enrollment Form typically includes the employee's personal identification data, contribution amounts, investment preferences, beneficiary information, and any other details required by the employer's plan.

Fill out your Generic 401K Enroillment Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

401k Enrollment Form Examples is not the form you're looking for?Search for another form here.

Keywords relevant to sample 401k employer match letter

Related to sample 401k letter to employees

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.