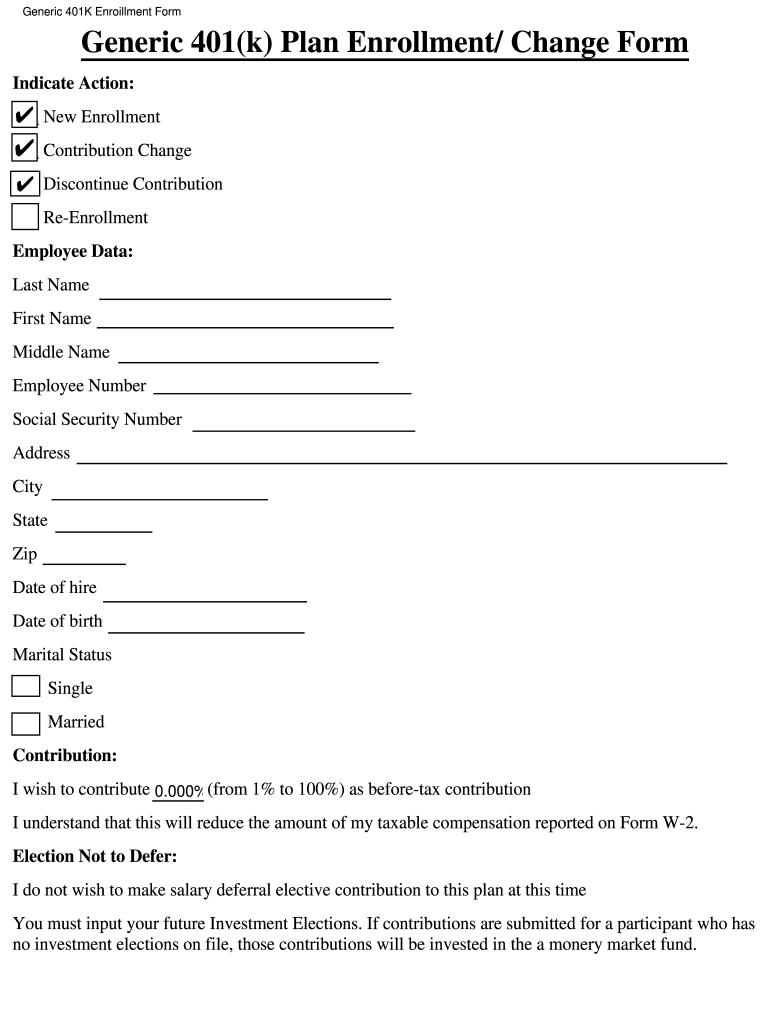

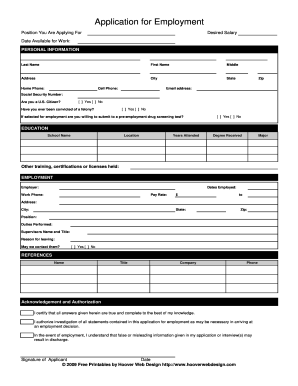

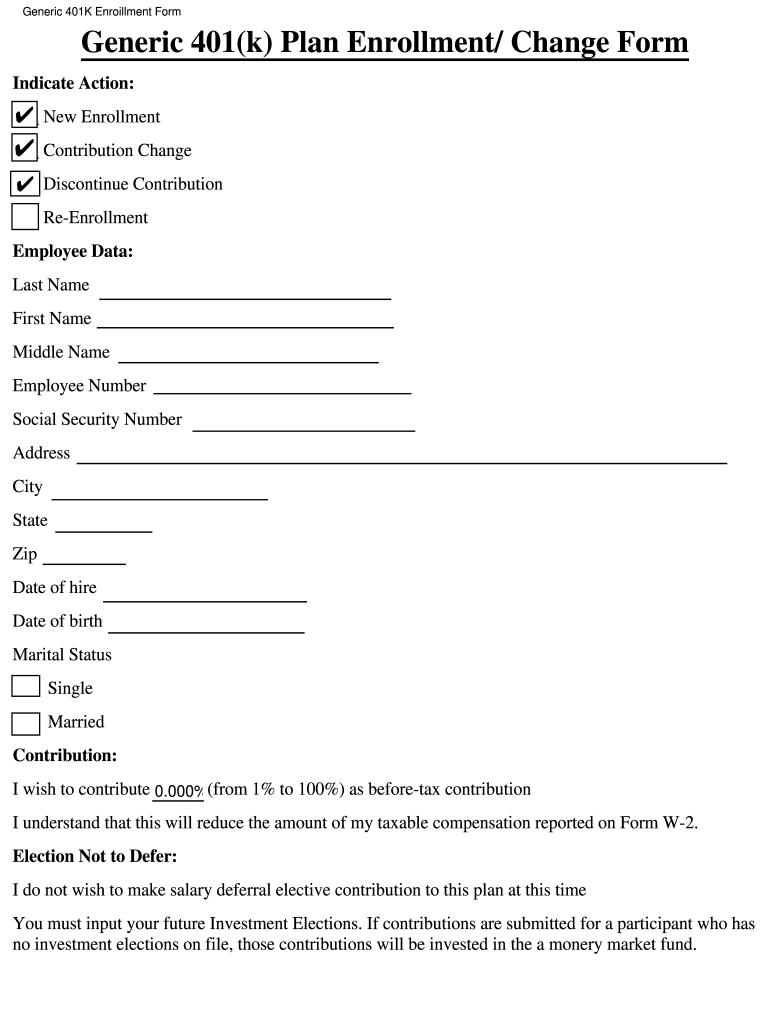

Generic 401(K) Enroillment Form 2003-2025 free printable template

Get, Create, Make and Sign 401k contribution form template

Editing tax form filing online

How to fill out what is 401 k enrollment form

How to fill out Generic 401(K) Enroillment Form

Who needs Generic 401(K) Enroillment Form?

Video instructions and help with filling out and completing sample 401k letter to employees

Instructions and Help about 401k sign up form

How's it going everybody visitors feed the bush today I'm going to talk about investing for absolute beginners now you could be a teen or just graduated from college, and you've got a job where they offer you a 401k option most the time they just go here you go and then there's a bunch of investment options, and then you just pick one of them, and then they go oh what's the division between this fund and that fund, and then you're left to try and figure it out yourself there's actually a lot more going on with the fund then you're just picking whatever percentage and just leaving it alone today I'm going to cover the things they don't actually tell you, but it's very important for you to know the background the psychology behind it just so that you are in informed an investor, and you know what to do when certain events happen the first thing to know is sometimes if you change companies they might boot you out of the plan, and they might cash you out when that happens actually withhold taxes from it, and they send you a check that's very, very bad if you ever let that happen you essentially have to open up a new IRA account put money in there including the withholding that you don't have anymore and also the penalty so let's say it's ten thousand dollars in the 401k account, and you got a check for like six thousand somehow you have to come out with another four thousand and put it in an IRA that might be really hard for someone just starting an incest so if you ever change companies and be kind of warned you they're going to close your account be very certain to roll it over as soon as possible because if you forget or fail to do it in time they will catch you out, and you're going to end up having to pay a lot of upfront money in order to avoid any penalties these company 401k plans usually have a lot of different funds that you can pick from generally I have seen anywhere from ten to twenty or thirty funds it's usually these target date funds sometimes they do have low expense ratio ETF funds or the indexes or whatnot, but this really depends on the plan that you have if you're just beginning to invest, and you got a total portfolio of maybe zero to twenty thousand dollars let's say the expense ratio is not going to be that bad on your total portfolio especially in the beginning because you don't have that much to compound yet, so you shouldn't be too worried about the expense ratio but just keep note of that whenever you have the chance to get a lower expense ratio do it if you're stuck in a plan that has high expense ratios don't freak out or anything let it invest if you ever changed up just roll it into an IRA and then at which point you can buy the low-cost index ones that you like a typical novice thing to do would be to time the market now I've done this myself I try to buy and sell a fun you essentially buy one fund within that 401k plan and then as soon as you sell it you actually cannot buy back into it for 30 days so what I...

People Also Ask about 401k form pdf

What is a 401 K enrollment form?

Do I need a tax form for 401k contributions?

Is there a form for 401k contributions?

Do 401k contributions have a tax form?

What is the form for 401k contributions?

What are the IRS guidelines for 401k contributions?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 401k flyer template?

Can I create an eSignature for the form 401 k printable in Gmail?

How can I fill out 401k decline enrollment form on an iOS device?

What is Generic 401(K) Enrollment Form?

Who is required to file Generic 401(K) Enrollment Form?

How to fill out Generic 401(K) Enrollment Form?

What is the purpose of Generic 401(K) Enrollment Form?

What information must be reported on Generic 401(K) Enrollment Form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.